Achieving Paperless Operations and e-Form Strategies with Adobe Experience Manager (AEM) Forms

Customer Introduction

The client is a leading financial institution specializing in personal banking, corporate finance, investment banking, and wealth management. Renowned for its outstanding customer service and innovative financial technology, the bank is committed to providing efficient and convenient financial solutions to individuals and businesses, helping them achieve their financial goals. By prioritizing customer-centric approaches, the bank continually enhances service experiences and maintains a competitive edge in a dynamic market.

Solution

Adobe Experience Manager (AEM) Forms

Project Background

Amid the wave of digital transformation, financial institutions are actively seeking ways to improve operational efficiency, enhance customer experience, and reduce costs. Traditional paper-based processes are not only cumbersome but also prone to errors, leading to extended processing times and lower customer satisfaction. To address these challenges, the client launched the “Paperless Operations and e-Form Strategy” initiative, aiming to transition all customer-facing and internal processes from paper-based to fully digital forms.

Challenges Faced

- Complex System Integration: Bridging the technical gaps between legacy and new systems.

- User Adoption: Encouraging internal and external users to embrace e-forms.

- Data Accuracy and Validation: Enhanced data validation mechanisms increased form design complexity.

- Security: Balancing sensitive data protection with user experience.

- Compliance: Meeting all regulatory requirements.

- Change Management: Managing role and responsibility shifts caused by new workflows.

- Feedback Loops: Effectively managing user feedback and prioritizing updates.

Project Goals

- Digital Transformation: Convert paper forms into interactive e-forms accessible and submittable online.

- Enhanced Customer Experience: Simplify form-filling processes and reduce waiting times.

- Operational Efficiency: Minimize manual data entry to lower error rates.

- Workflow Integration: Ensure seamless data flow within existing systems for faster responses.

- Data Accuracy: Enable source-level data validation to minimize post-submission corrections.

- Scalability: Build a system that supports future expansions, including new forms and functionalities.

Our Solution

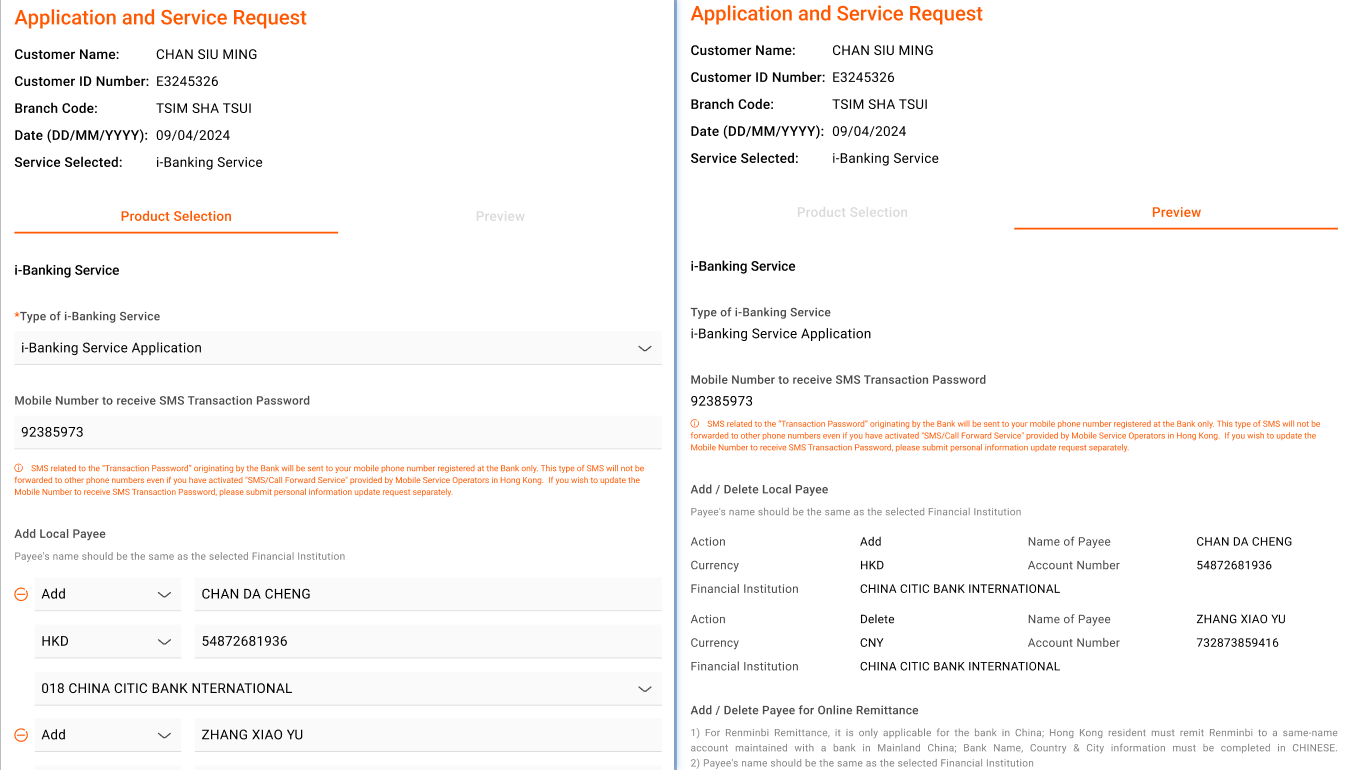

1. We utilized AEM Forms to design and deploy a robust solution over three phases spanning more than a year. This initiative successfully implemented four complex digital forms, including:

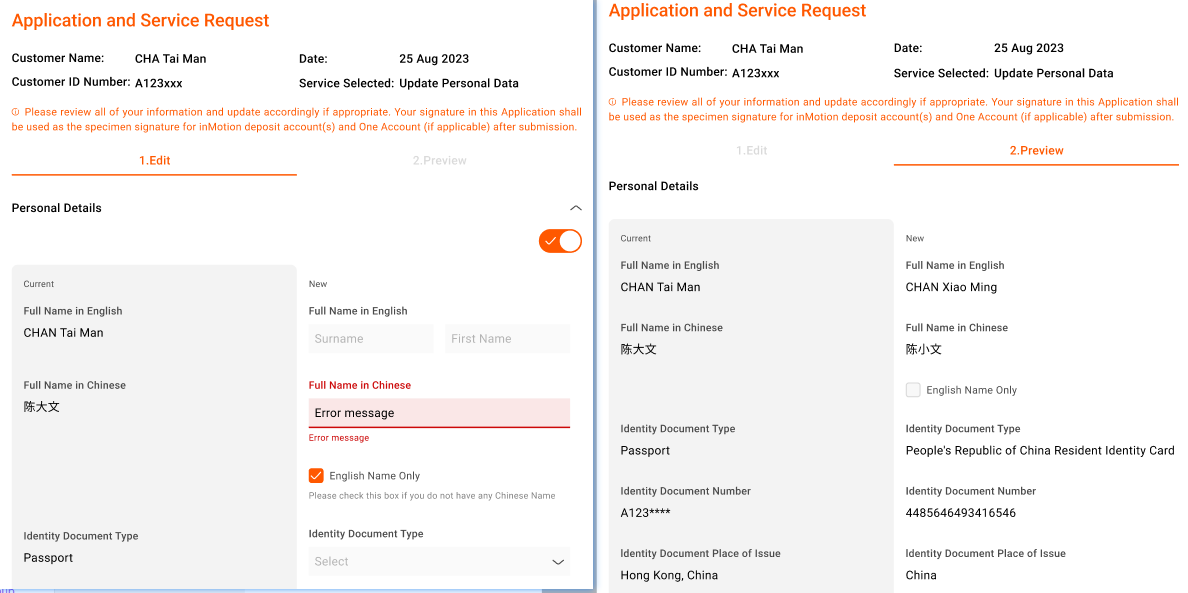

- Customer Information Maintenance Form: Allows customers to quickly submit information update requests.

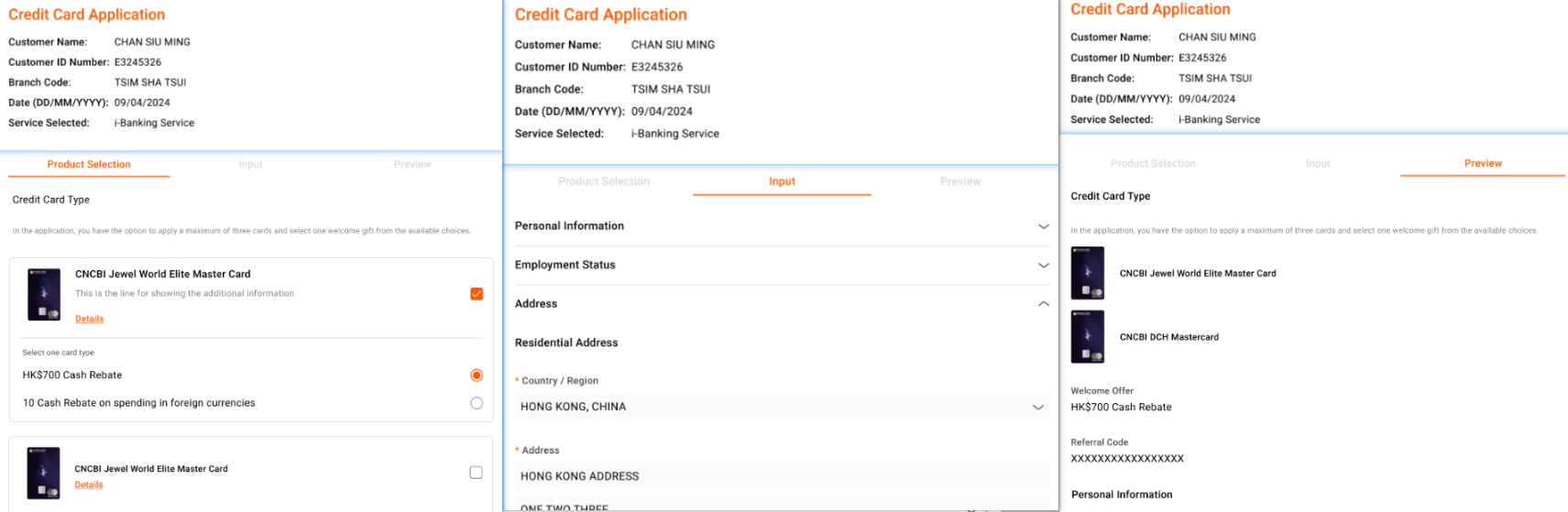

- Credit Card Application Form: Simplifies the application process, improving approval efficiency.

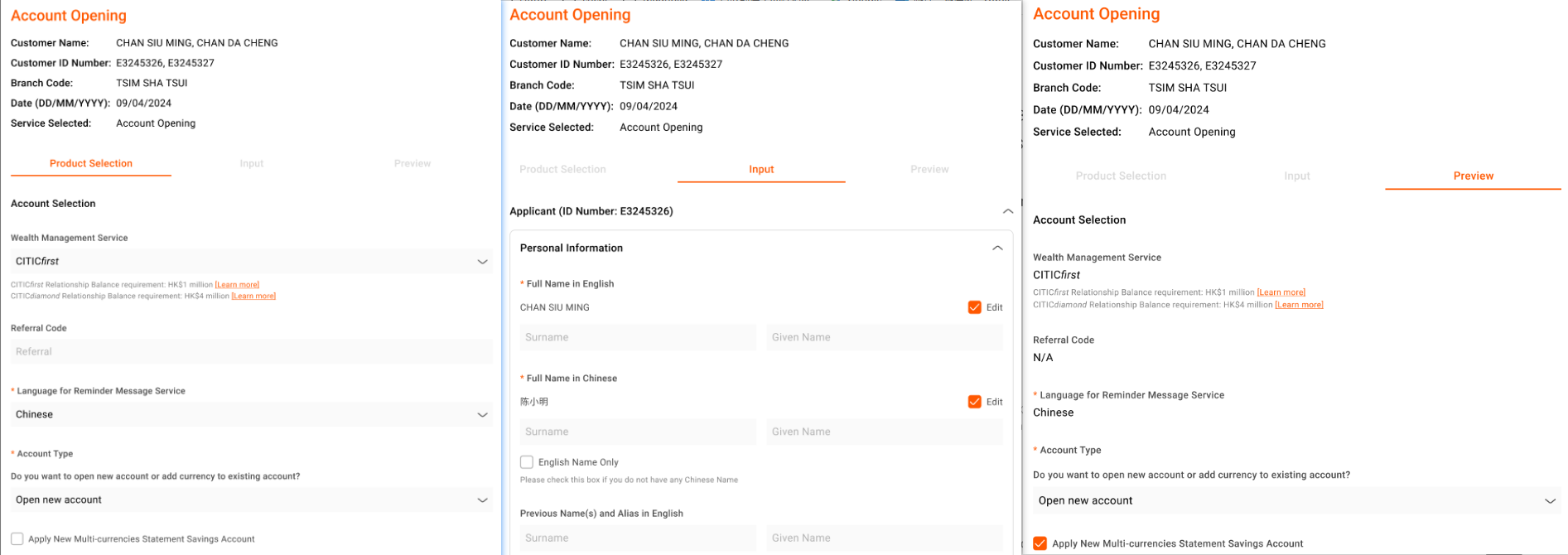

- Customer Account Opening Form: Enables customers to open accounts while allowing bank staff to review requests online, reducing account setup time.

- Online Banking Application Form: Facilitates self-service online banking activation.

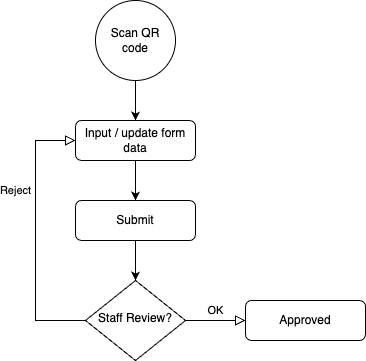

2. Process Flow Diagram

3. Key Features of Our Solution

- Dynamic e-Forms: Dynamically display relevant fields based on user inputs to enhance user experience.

- Multi-Language Support: Supports Traditional Chinese, Simplified Chinese, and English to accommodate users with diverse language preferences.

- Pre-Filled Data: Reduces user input and improves data accuracy.

- Security and Compliance: Implements multi-layer data encryption and access control to meet all regulatory requirements.

- Mobile-Friendly Design: Ensures responsive design compatible with various devices.

- Real-Time Data Validation: Ensures data accuracy and reduces the need for corrections.

- Seamless Workflow Integration: Enables efficient data transfer to enhance overall operational efficiency.

Project Outcomes

- Improved Efficiency: Significantly reduced processing times, boosting customer satisfaction.

- Cost Reduction: Decreased paper usage, promoting sustainability.

- Enhanced Data Accuracy: Strengthened source-level validation, lowering correction rates.

- Improved User Experience: Provided convenient form-filling and submission processes, improving service quality.

Conclusion

The project achieved outstanding results, marking a critical milestone in the client’s digital transformation journey. Through close collaboration with Leads Technologies, the client successfully built a highly efficient and flexible e-form system, laying a solid foundation for future expansion.